Dedale Intelligence’s B2B software market update for June 2025: valuations, stock performance, deals & investor insights

Written by :

Matthew Cortez

September 12, 2025

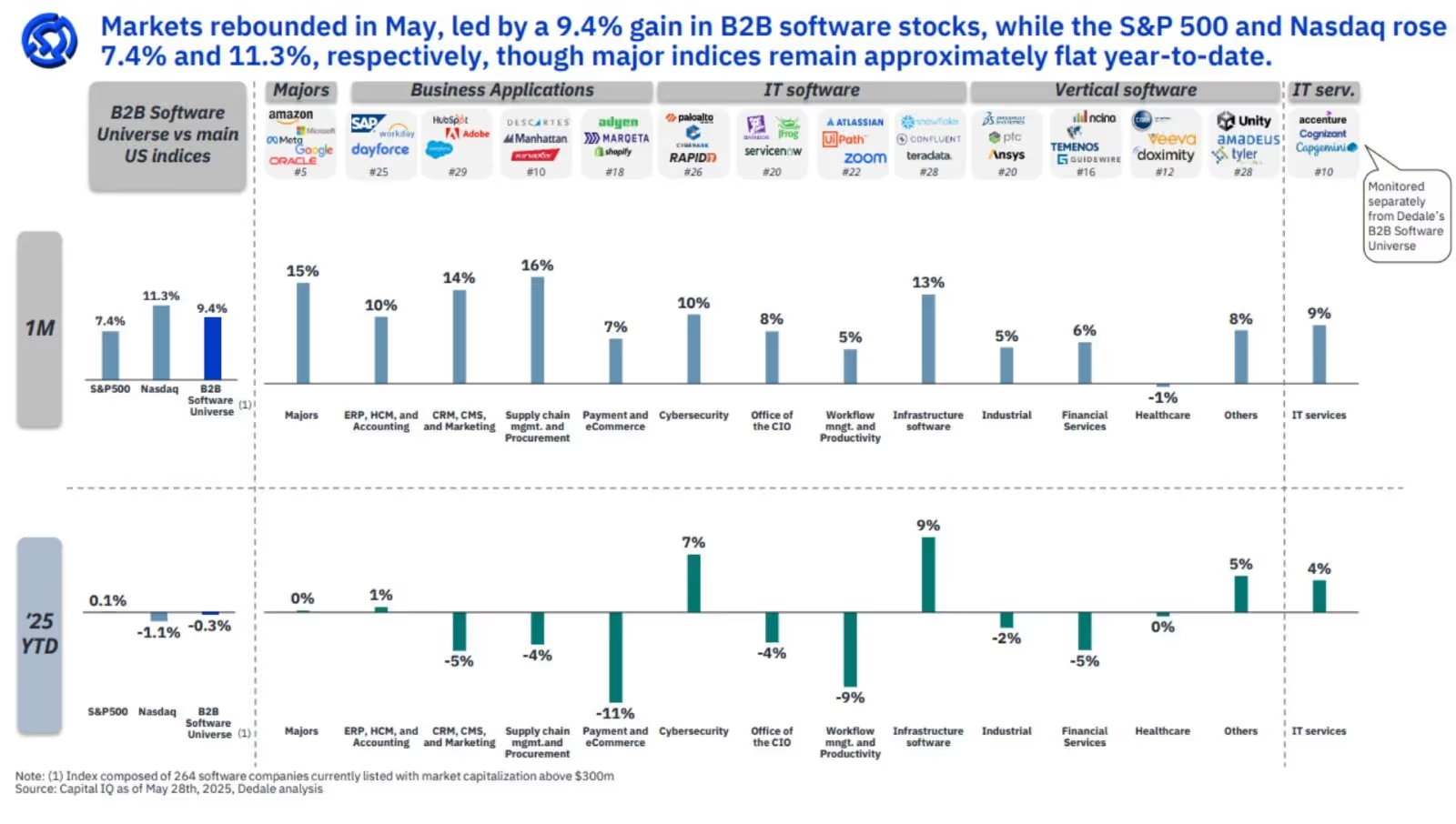

May was a strong month for the B2B software space, with our universe of 250+ publicly listed companies in North America and Europe gaining nearly 10% in market capitalization. This recovery followed a turbulent start to the year and was largely in line with broader macro-driven rebounds observed in the S&P 500 and NASDAQ.

Despite this monthly surge, year-to-date performance remains flat, with the sector oscillating between recovery and caution. Segments tied to supply chain management and procurement saw particularly strong performance. As part of our extended scope, Dedale is now also tracking IT services companies, acknowledging their growing importance and distinct valuation profile compared to pure software players.

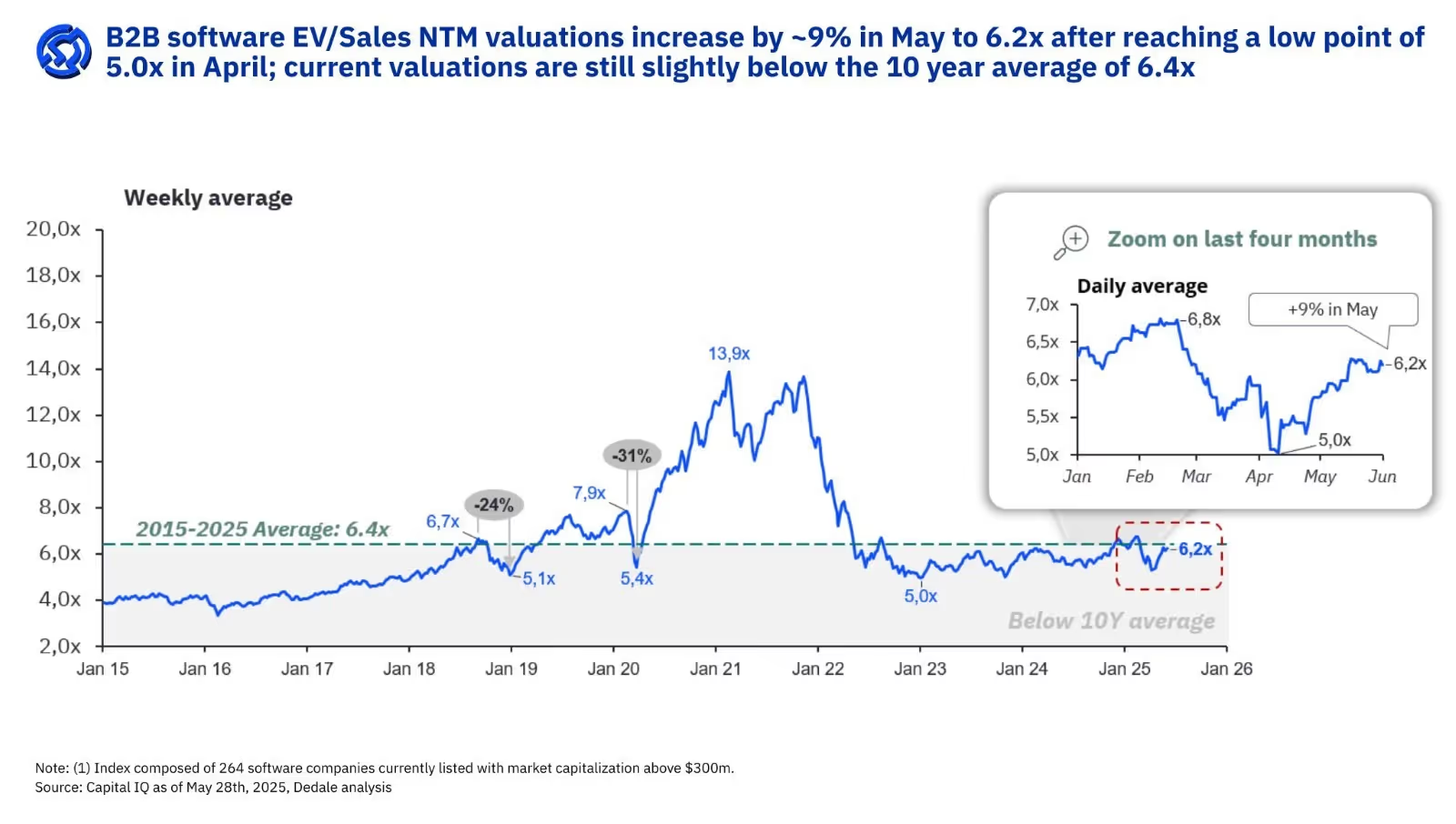

Valuations rebounded in May:

High-growth companies (>20% revenue growth) led the valuation recovery, now averaging 11.2x EV/Sales, and are the only cohort with valuation gains year-to-date. In contrast, mid-growth (10–20%) and low-growth (<10%) companies sit at 7.3x and 4.1x respectively.

Free cash flow margins have remained flat at just under 20%, and while sales growth for the broader software universe hovers just above 10%, no re-acceleration is currently observed.

Geographically, North American companies outperformed, now trading at a 54% premium over European peers (6.7x vs. 4.4x EV/Sales), reflecting a shift back to perceived market safety amidst geopolitical headwinds.

After a strong Q1, deal momentum slowed in Q2 due to geopolitical uncertainty. While large-cap buyouts saw a pullback, small and mid-cap transactions remained resilient, especially in vertical software and aggregator-led consolidations.

Key deals this month included:

May earnings were overwhelmingly positive, with most software players meeting or exceeding expectations. Yet few raised full-year guidance, reflecting management caution in a still-uncertain macro context.

Notable names:

Top names we are actively following:

Want access to the full market session?

Dedale Intelligence’s market sessions offer a curated and data-driven lens into what’s really happening in B2B software. We go beyond headlines to deliver segment-level insights, valuation dynamics, and investor signals, month after month.

Contact us to learn more about membership and access the full presentation.

Get started

Dedale is growing fast and we are continuously looking to widen our reach in the ecosystem. Let's connect!

Members

Join our Community of Industry Veterans that we collaborate with to conduct deep research

Join the community

Investors, Corporates, and M&A Advisors

Learn more about how collaborating with Dedale Intelligence could enhance your intelligence generation efforts

Request an introduction

Talents

We are looking for smart, hungry, humble individuals to join our fast growing team worldwide!

Join the team